20+ 403b calculator 2021

In 2022 100 of net adjusted business profits income up to the maximum of 20500 and 27000 if age 50 or older can be contributed in salary deferrals into a Solo 401k 2021 limits are 19500 and 26000 if age 50 or older. I had been so focused on FI for the last 5-10 years that I never took the time to consider Coast FI till recently.

App Icons Halloween Ienjoyediting

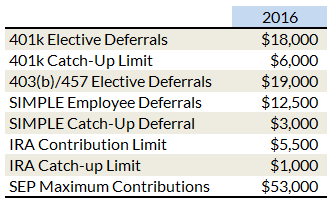

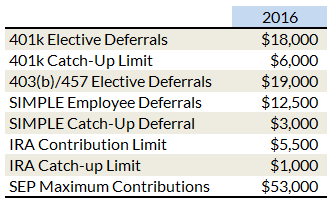

This includes direct contribution plans such as 401k 403b 457b plans and IRAs.

. Dec 3 2021 1029am. A Solo 401k allows you to keep those earnings to reinvest year after year. Paraprofessional council of the ofallon federation of teachers local 3939 for school years.

Citizens Guide to the Budget. The CARES Act of 2020 provided a temporary waiver of RMDs. CD Calculator Compound Interest Calculator Savings Calculator.

The IRS sets limits on the amount of money that can be contributed to your voluntary retirement plans. Local Schools Tax Calculator. No net worth calculator cares about how much you make.

The table is very lengthy as it has every combination of ages for 10 spouses 10-years apart in age. Contributing the max to both accounts results in a total tax deferral of 41000 per year not including catch-up contributions. Associated Student Body Information.

The stock is about 20 below its early 2021 high. And in good time LMAO according to your calculator Im right around my Coast FI number at a time when Im going to go part-time with my current employer or take. Citizens Guide to the Budget.

2019-20 District Budget Extensions. On Thursday September 15th 2022 the average APR on a 30-year fixed-rate mortgage rose 1 basis point to 6094The average APR on a 15-year fixed-rate mortgage rose 1 basis point to 5231 and. Yes you can max out both your 401k and 457 plan up to the maximum allowed by the IRS which is 20500 for each account.

EP. This table provides more favorable ie. Including 401k and 403b.

Bureau of Deferred Compensation. Thats a serious tragedy to presumably earn 20-30 years of physician-level paychecks and have less than 500K to show for it. Profit Sharing Contribution A profit sharing contribution can be made up to 20 of net adjusted businesses profits.

The RMD waiver is for retirement plans and accounts for 2020. Before investing consider the investment objectives risks charges and expenses of the fund or annuity and its investment options. For 2021 the capital gains tax can be as high as 20 with it having been as high as 28 and even 35 in the past.

The most you can contribute as an elective deferral to a 403b plan in tax year 2022 is 20500. Contact Fidelity for a prospectus or if available a summary prospectus containing this information. Associated Student Body Information.

Buy vs outsource 403b 503020 rule. Your employer may say you only gain ownership over 20. My Retirement Manager Retirement Manager is.

The forward PE of 252 is justified for the growth. Local Schools Tax Calculator. LoansHardships Withdrawals requests are processed through My Retirement Manager.

The federal taxes approximated based on the 2021 marginal tax tables published by the IRS without taking account of possible deductions. This is up from 19500 in 2021. FIU 403b Plan Document.

RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. But today lets go through every age category and discuss the physician millionaires. You can contribute an additional 6500 as a catch-up contribution if youre age 50 or older.

Had a roommate in residency and always maxed my institutions 403B plan. By completing the paraprofessional certificate a student can supplement the. Page 2 of 17 table of contents preamble 4 article 1-recognition 4 article ii-council and paraprofessional rights 4 a.

2021-22 District Budget Extensions. EP. Zillow has 41 photos of this 250000 2 beds 1 bath 770 Square Feet condo home located at 502 Bayshore Dr UNIT 37 Ocean City MD 21842 built in 1972.

2019-20 District Budget Extensions. Right to organize 4. This is a great way to maximize your tax advantages for those looking to quickly bulk up their retirement accounts.

There is another table for IRA account holders with spouses 10 or more years younger where the spouse is name as the sole beneficiary. 2021-22 District Budget Extensions. For instance a 50000 investment at 12 interest becomes more than 90000 when compounded for 5 years.

The lottery annuity calculator helps you estimate the yearly annuity payouts and any applied taxes for a given lottery jackpot. Thanks for the great breakdown of Coast FI and the calculator. The 403b is for non-profit and government employers while the 401k is offered by for-profit companies.

And salary range u. One of the most popular posts on the blog so far has been my article describing how you can build simple index fund portfolios including my favorite three-fund portfolio using Vanguard index fundsUsing the funds from that article you can build a diversified portfolio of index funds at very low cost using Vanguard funds. 403b.

How To Retire Early

Early Retirement Calculator Spreadsheets Budgets Are Sexy

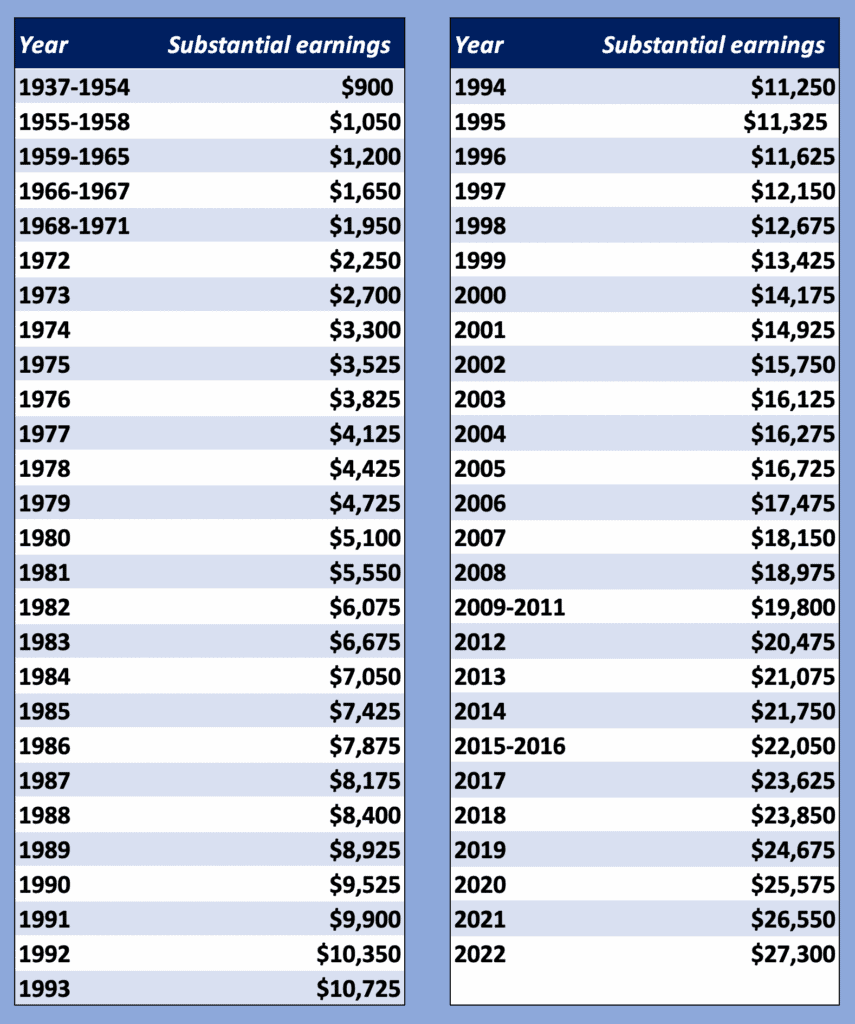

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence

Is Investing In Dividend Stocks A Good Strategy

How Much Money Is Enough To Retire At 40 In Kolkata Quora

How To Access Retirement Funds Early

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How To Retire Early

2

Social Security Exemption Archives The Pastor S Wallet

Early Retirement Calculator Spreadsheets Budgets Are Sexy

Mysocialsecurity The Free Account Everyone Needs To Set Up Before Retirement

General Fi Archives Managing Fi

When Is The Best Time To Collect Social Security

Retirement Plans Offered By Amcs Student Doctor Network

Early Retirement Calculator Spreadsheets Budgets Are Sexy

How To Do A Backdoor Roth Ira Step By Step Guide White Coat Investor